IMPACT

From 2020 through 2021, Hey Sister reached more than 238,000 people directly — including an estimated 177,000 women across Ghana, Malawi, and Uganda — and as many as 740,000 people indirectly.

Hey Sister! seeks to build women’s digital financial literacy and decision-making skills so that they can effectively use digital financial services (DFS) to economically improve their lives.

To assess our progress towards this goal with the first 10 campaign episodes, SIA conducted baseline and midline surveys for our two populations of participants: 1) people who called into the IVR line and 2) participants in facilitated groups supported by one of our on-the-ground partners. The surveys were conducted 5-7 months apart. SIA later conducted an endline survey in November 2021 among group participants to assess the impact of all 25 campaign episodes. (Read more about methodology here.)

The surveys measured several dimensions that Hey Sister! may impact:

Women’s application of new approaches to use DFS;

Women’s level of confidence using DFS;

Changes to other dimensions of women’s empowerment; and

Reach beyond direct participants.

Results around each of these dimensions are discussed below. As expected, we found greater changes among the respondents who participated in facilitated groups, as they are more likely to have: 1) heard all of the episodes (IVR respondents heard a minimum of two), 2) benefited from group discussion and facilitation to strengthen learning and motivation for action, 3) been in the demographic group for which the content was designed (lower-income, less digitally connected women). Nonetheless, even the more modest IVR results reflect significant potential for change given the scale of people reached through a mass communications platform.

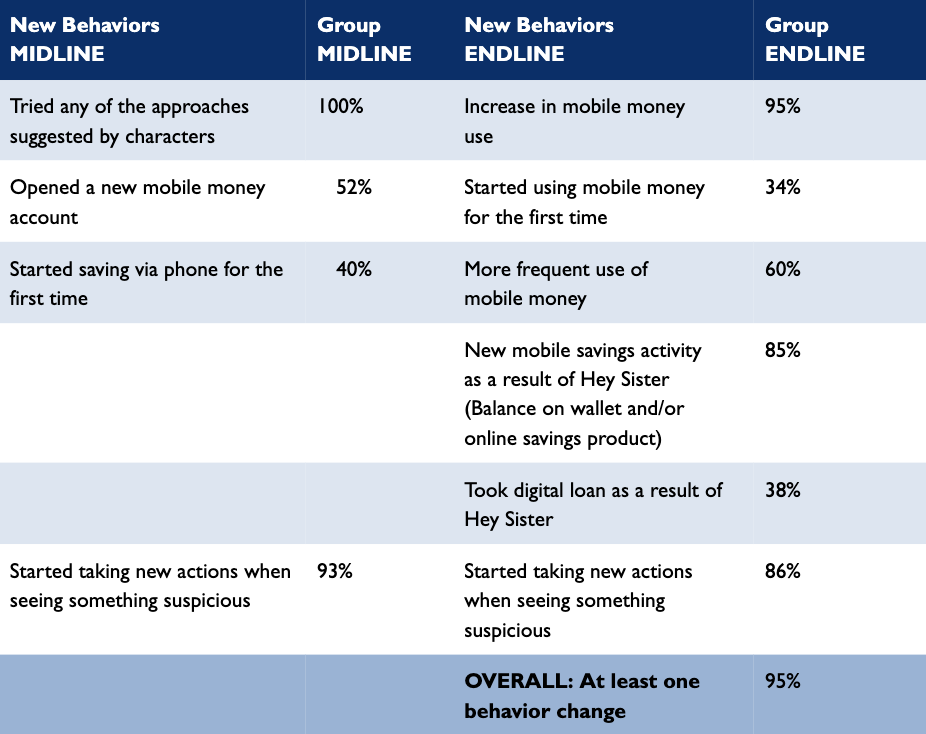

APPLICATION OF NEW STRATEGIES

While Hey Sister! does not promote any specific DFS products, it does encourage listeners to adopt new DFS activities as its characters do, such as using mobile money, saving digitally, and identifying and avoiding false information and scams. Informed uptake of such practices may help women realize more positive value from DFS while improving their literacy skills and confidence.

“Even though I registered for mobile money three years ago, I had very little knowledge about it. With this training, I can also train the women groups in my community. I am very happy about this digital financial literacy education for women.”

“I have learned a lot from the digital financial literacy training. Before, I didn’t know that one can use the mobile phone to do many things. I now know that you can save, borrow, and do business through the mobile phone.”

New Behaviors Among Group Participants (Midline vs. Endline)

Increased PIN protection emerged as a popular behavioral change among group participants from baseline to endline. The proportion of women group participants who do not share their PIN with anyone increased dramatically from 21% to 70% as they heard more episodes.

Who do you share your PIN with? (group participants)

“They sent me 700,000UgX through mobile money on my phone, but using the training knowledge that I had, I first checked my balance and I realized that the 700,000UgX was not reflected on my mobile account. I went ahead to analyze the message I had received earlier and realized that the message was a mere text message from a scammer’s mobile number. I later laughed at myself because nobody would endeavor to send me 700,000UgX free of charge.”

Endline data shows that entrepreneurs have also adopted new behaviors after listening to the Hey Sister episodes. After rolling out the first ten episodes, our team designed four episodes catered to entrepreneurs based on participant feedback gathered from earlier surveys. As a result of Hey Sister, 89% entrepreneurs have made a change in usage of DFS for their business, including switching to mobile money payments and even starting to save revenue on a mobile money wallet.

Entrepreneurs using mobile money for their business

CHANGES IN CONFIDENCE USING DFS

While not a perfect proxy for literacy, confidence may reflect skills development as well as greater understanding of concepts or products that were previously difficult to grasp, and may tell us more about respondents’ likelihood to use a product. Increases in women’s confidence were observed among both the IVR and facilitation discussion groups, with a more dramatic change seen among group participants.

Question: “How confident do you feel using your phone

for financial transactions like mobile money?”

IVR (% of women)

“To be honest I’ve never registered for mobile money but I’ve seen the effect on my life and business, and I regret not having my own account. I’m a trader, and there have been a number of occasions where I go to the market to buy goods and later become cash-trapped with items on my list yet to be bought. When I call someone to send me money, it’s usually sent through others accounts and they withdraw it for me. I have to beg people for these monies to be sent through their accounts. My learning is that having my own account could be more confidential. I will now register for mobile money to be able to transact my business with it.”

CHANGES IN AGENCY (HOUSEHOLD)

Recognizing that other factors beyond digital financial literacy can enable or restrict women’s DFS usage and the value they are able to capture from it, Hey Sister! seeks to influence broader change for women’s empowerment. The audio episodes feature role models — women taking active roles in their finances and supportive husbands — and our facilitator resources and training include tips on gender-sensitive facilitation for women’s empowerment.

In order to assess whether any changes occurred in women’s household agency, the surveys asked women about their role in household decision making. Knowing that this type of change can be hard to influence, we weren’t surprised when we didn’t see a pattern of change across the women IVR callers. A trend toward “more empowered” household decision making appeared to emerge between the group baseline and midline surveys, but this trend did not continue to the endline. Nonetheless, several partners observed an increase in women’s voice in household decision making. For example, a Ghanaian partner reported “DFL greatly boosts women’s ability to operate independently, especially of their husbands (if married), and successful DFS use enables women to be more in control of their finances in terms of expenditure decisions and investments in their livelihoods. This is particularly important in northern Ghana where men generally have a great influence on women’s income and use of money.”

Question: “What is your role in household decisionmaking?” (% of women)

ADDITIONAL REACH

To fully understand the reach of Hey Sister! and its potential impact on digital financial literacy, we asked respondents about their engagement with others (outside facilitation groups) around what they learned. Both IVR and group participants discussed the content with others in their networks and communities. In fact, at the endline, surveyed group respondents reported discussing the content with 15 other people, on average, and 90% reported teaching someone else how to use mobile money as a result of the content. Although the midline survey showed a minority of IVR callers discussed the content with others, the scale of platform callers means that still many more people were reached with some information.

Question: “With how many people (outside your group) have you discussed Hey Sister! content?” (% of women, based on midline survey data)

Among IVR-surveyed women, 52% said they had shown someone else how to use mobile money, while 100% of surveyed women group members said they had. Participants shared with a wide range of connections, from mothers, daughters, and grandmothers to sons, husbands, uncles, and cousins to school teachers, neighbors, choir members, business partners.

“Soon after Chileka Ticheze Amayi Group received training, members of the group began training other groups to promote the Hey Sister! Content.”

WHAT’S NEXT FOR HEY SISTER?

The surveys serve as a useful proof of concept that Hey Sister! is creating desired results across various dimensions and topics. Open-ended responses from group participants during the endline survey revealed the information that proved to be most useful in their business and private lives. The most common themes mentioned by participants were learning how to identify and avoid scams, with 60% of group participants saying it was the most significant impact of Hey Sister. Several other themes proved to be useful for participants, including using mobile money for savings, restructuring loans, buying airtime on phone or monitoring transaction charges, pointing to the diverse ways in which Hey Sister built women’s digital, financial, and digital financial literacy.

Group Participants: Most Significant Impact of Hey Sister

Even though SIA’s active implementation of Hey Sister ended in December 2021, we will continue to host the Hey Sister content on our website, available for streaming and download to anyone free of charge. We will also continue to promote and incorporate Hey Sister into our own programming, so as to maximize reach and impact. Our IVR dissemination partner Viamo plans to keep Hey Sister up on its IVR platforms in Ghana and Uganda for free access to callers, and we also expect Hey Sister to remain available on MTN Ghana’s IVR platform well into the future.

The positive impact of Hey Sister has also been noticed by our facilitation partners. All 19 of the active facilitation partners as of December 2021 plan to continue using Hey Sister in their programs in Ghana, Malawi, and Uganda. The facilitation partners developed sustainability plans describing how they intend to continue using the Hey Sister content in their ongoing training activities, to expand training activities, and to integrate Hey Sister content into new programming.

# nonprofit and for-profit entities that intend to continue using learning tools after activity ends

The 2021 Global Findex data underscores why providing open-source digital financial literacy tools, like Hey Sister, remains important to build women’s confidence and capabilities. Two-thirds of unbanked adults around the world say they would not be able to use a financial account without help. In Sub-Saharan Africa, women are five percentage points more likely than men to need help to use their account. By keeping Hey Sister free and available on our website, we are confident that the campaign will continue to have a long-lasting impact on building women’s digital financial literacy and supporting increased economic empowerment.

METHODOLOGY

IVR surveys in Ghana, Malawi, Uganda: In October-December 2020, callers who listened to a Hey Sister! episode were invited to take the baseline survey. In May-June 2021, baseline callers who called in again and listened to an episode were invited to take the midline survey. Due to the possibility of different people calling in from the same phone, respondents were kept in the midline data only if their reported gender matched their gender from the first survey. Though the baseline surveys had a total of 10,284 respondents, these restrictions meant the number of eligible midline respondents was significantly lower, at 453 (304 women). Both of the IVR surveys were conducted when only 10 Hey Sister episodes were available. We faced challenges in endline data collection from our IVR partner, making midline results the most relevant data to analyze for this group.

Facilitated groups in Ghana, Malawi, Uganda: SIA staff conducted the surveys by phone, using a sample of group member phone numbers provided by partner facilitators. Because baseline eligibility required participants to have heard no more than three episodes, some participants could not be included because the facilitators had already discussed more with the group. The midlines were administered to the same (eligible) baseline participants: a total of 91 women across the three countries. The baseline surveys were conducted as groups began discussions in January-February 2021 and the midlines in June-July 2021. In August-September 2021, a second baseline survey was administered among female group participants with no eligibility restrictions around the number of episodes heard. The endline survey was administered in November 2021, for a final group participants sample of 277 women.

Greater detail on implementation and monitoring and evaluation of the Hey Sister project can be found in the project’s final report.