Four lessons for growing women’s digital financial literacy at scale

According to GSMA’s newly published Mobile Gender Gap Report, Literacy & Digital Skills is still the top barrier to women’s adoption of mobile internet and the second highest barrier to women’s mobile phone ownership. The World Bank Group’s recently released 2021 Global Findex Database found that one-third of mobile money account holders in Sub-Saharan Africa need help to use their account, and notes that less experienced digital financial services (DFS) users are vulnerable to fraud and financial abuse.

Several years ago, USAID asked SIA to help organizations around the world grow women’s digital financial literacy so that they can more effectively use DFS to economically improve their lives, with a focus on rural women in low-income countries. We were unsure how many different sets of learning materials we would need to design for such a broad population — each with differing socio-economic circumstances, baseline levels of literacy, patterns of phone ownership, and digital financial products available to them.

To find out, we produced an initial, single set of 10 dramatized audio episodes of “Hey Sister! Show Me the Mobile Money!” in the languages of Ghana, Malawi, and Uganda. We put the audio lessons on call-in lines with mobile network operators so customers could call in for free at times most convenient to them. We also posted the content on our website, along with facilitator guides for partners to lead group discussions.

This approach worked. In early polling among 304 rural women participants, 98% found Hey Sister relevant to their lives. As they listened to more episodes, women’s confidence grew in conducting digital transactions via phone (“very confident” respondents rose from 43% to 90% in the span of five months). In response, SIA produced 15 more episodes, incorporating topics requested by listeners and partners. Over the course of a year, we saw significant changes in digital and digital financial behaviors among participants, including increased mobile money use, increased mobile savings, and reduced PIN sharing.

Here are four lessons that could help others working to grow women’s digital financial literacy and uptake:

1. Standardized learning resources can be valuable across heterogeneous populations, with some design attention.

While programs should not treat women as a homogenous group, it is still possible to serve them through common learning resources that are standardized and scalable. In our program, baseline respondents were mixed in whether they had used mobile money before and in their level of confidence in using DFS, but almost all of them found the lessons useful and changed their behaviors in response. We accounted for heterogeneity among learners through several design considerations, including:

Short duration: Episodes are 3-5 minutes each, so even if a woman did not immediately learn anything new from one episode, there were other chances for learning within an hour-long group meeting.

On-demand topics: We encouraged partners to play episodes relevant to their group, while individuals could call in to listen to any topic they choose.

Character archetypes: We based our characters around several “archetypes” developed by ideo.org so that most listeners could identify with the circumstances and capacities of at least one of the actors.

2. Product-agnostic learning supports general capacities as well as uptake of specific products.

Many programs that build digital or digital financial literacy teach participants how to use a specific digital product (i.e. an app or mobile money service). However, rather than providing a “how-to,” our curriculum builds core capacities in financial literacy, digital literacy, and digital financial literacy that are product-agnostic and will equip learners to adopt new digital products as they come online. We found that topics in high demand among our audience tended to be product-agnostic. Learning how to avoid scams was not only a requested topic for more attention in future episodes, but was the most prominent story of change told by our participants and partners. Among surveyed participants, 97% started taking new actions when encountering something suspicious on their phone.

In our search for partners, some were only interested in adopting learning materials customized to their specific product, while others saw the potential of product-agnostic resources and realized value for their organization. For example, a savings and loan cooperative in Uganda noted higher uptake and repayment rates as a result of Hey Sister, while a Ghanaian agribusiness now uses mobile money to pay women farmer suppliers. Toward the end of the project, MTN/Ghana put Hey Sister on its national IVR line, with the expectation that increased DFL will grow its DFS client base.

3. Digital financial literacy grows with exposure and an empowered household role.

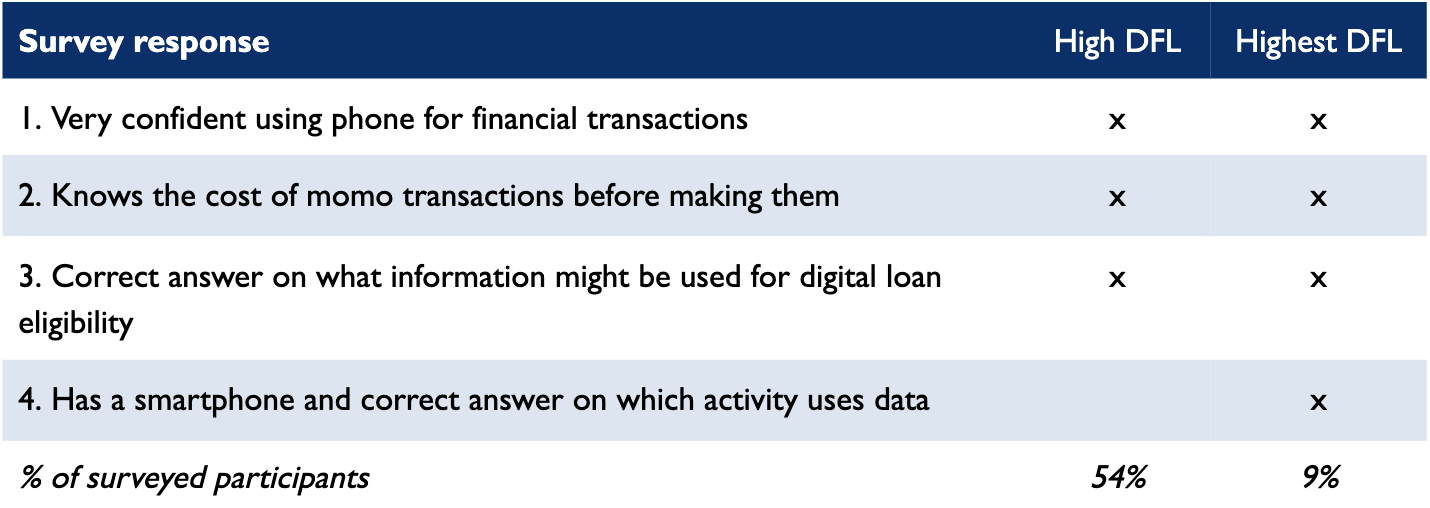

Amid limited resources, long distances, and a somewhat fluid participant population, we did our best to measure change among group participants through phone surveys. We used a short composite measure to assess DFL, using both self-reported knowledge and confidence, as shown in the table below:

No respondents scored in either category at the beginning of the project. At project end, 54% of surveyed participants scored as “high DFL,” and 9% met the criteria for “highest DFL” (46% still did not meet the criteria for either category, though many still showed positive behavior uptake). Our sample showed no observable correlation between DFL and age or household income level. Factors that appear important for higher DFL among Hey Sister participants are a longer amount of time spent participating in Hey Sister and/or listening to more episodes, and a more empowered role in household decision making.

The highest DFL group did start with higher digital financial exposure than average — all started as “very confident” and had used mobile money before. Still, their DFL notably grew during the program; none met the high DFL level in a survey conducted just three months before the endline (and none owned a smartphone). At that time, the average number of episodes heard was 15; by the end, all had heard all 25 episodes of Hey Sister.

4. Digital financial literacy correlates with DFS behavior uptake.

DFL, as we defined it, became clearly correlated with higher uptake of new digital and financial behaviors discussed in Hey Sister. As shown below, 100% of women in the highest DFL group pursued all of our surveyed digital and financial actions (even though some, like opening a new mobile money account or taking a digital loan, weren’t explicitly encouraged) and the high DFL group was not far behind. Uptake was lower among the full participant population, though most of the numbers still indicate significant change. Critically, because the uptake was self-directed as the result of learning, we expect that the women may use the DFS, on average, to greater value than if the product had simply been promoted to them.

These four learnings not only affirm the importance of literacy for DFS uptake, but also offer optimism for addressing this need creatively and cost-effectively at large scale. In a little over a year, approximately 260,000 people listened to Hey Sister on a call-in line and/or through a discussion group. Its reach continues to grow, as it remains on call-in lines in multiple countries, has been produced in additional languages (including French, Swahili, and Spanish), and taken up by additional organizations around the world.